27++ Perfectly Inelastic Demand Curve Tax

Perfectly Inelastic Demand Curve Tax. In other words, buyers and sellers are both more burdened when demand is more inelastic than supply. Insulin for diabetics is generally considered to be perfectly inelastic with regard to elasticity of demand.

Insulin for diabetics is generally considered to be perfectly inelastic with regard to elasticity of demand. About press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features press copyright contact us creators. The incidence (split) of sales tax is determined by the.

peinture envie rose boreal paulmann lampen urail peinture bois exterieur v33 leroy merlin piscine bois hors sol promotion

Elasticity and Pricing · Economics

About press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features press copyright contact us creators. It is important to remember, though, that taxes finance government spending, which also contributes to the position of the demand curve. As we move down the demand curve from a to b the price falls by 33 and quantity demanded rises by 33. When the demand is inelastic, consumers are not very responsive to price changes, and the quantity demanded remains relatively constant when the tax is introduced.

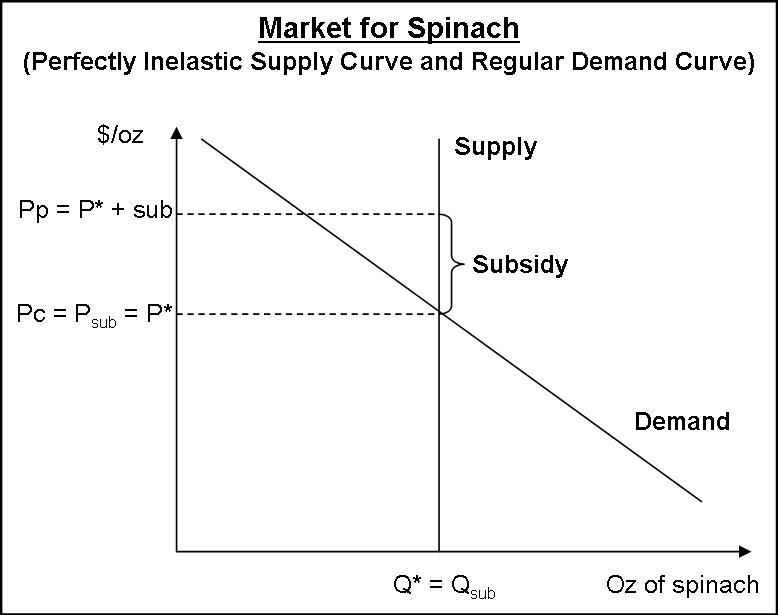

An interesting case of taxes and tax incidence is when one of the curves is perfectly elastic. In other words, buyers and sellers are both more burdened when demand is more inelastic than supply. The buyer bears a greater portion of the tax burden when either demand is inelastic or supply is elastic, as depicted in diagrams # 1 and.

It is important to remember, though, that taxes finance government spending, which also contributes to the position of the demand curve. Conversely, if demand is perfectly elastic or supply is perfectly inelastic, producers will bear the entire burden of a tax. As shown in the accompanying diagram, if the demand for cigarettes in north texarkana is perfectly inelastic, the demand.

An interesting case of taxes and tax incidence is when one of the curves is perfectly elastic. If a demand curve is. The buyer bears a greater portion of the tax burden when either demand is inelastic or supply is elastic, as depicted in diagrams # 1 and # 4, respectively. Deriving demand curve from tweaking marginal utility per dollar..

An example of the perfect elastic supply curve is the market of the capital for small countries or businesses. How does tax affect perfectly inelastic demand? It doesnt matter what price you pick. About press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features press copyright contact us creators. Insulin for diabetics.